Once the various costs are meticulously identified, they are strategically allocated to the respective construction projects on which they occurred. The allocation involves distributing direct, indirect, and overhead costs to the respective construction projects, each requiring a distinct approach. Job costing provides a clear view of all the direct and indirect costs and how they affect the budget. It also gives you a better idea of the potential risks, allowing for proactive management. This leads to fewer financial surprises and better handling of unforeseen issues. In job costing, the cost is maintained for each job or product by calculating all expenses, including materials, labor, and overheads.

What is the approximate value of your cash savings and other investments?

- By breaking down large-scale and complex projects to a unit level, job costing simplifies management, enhances profit recognition, and helps in ensuring the financial sustainability of the company.

- On completion of a job, a job completion report is sent to the costing department.

- If you’ve recently done a similar job to the one you’re currently quoting for, then you can bring up an old template, edit as needed, and immediately see your labor costs and overhead rate.

- This tool is particularly effective for expensive or complex projects, providing a detailed breakdown of costs at a unit level.

- By providing a detailed breakdown of all expenses at a unit level, job costing enables businesses to make data-driven decisions, better allocate resources, and streamline project management.

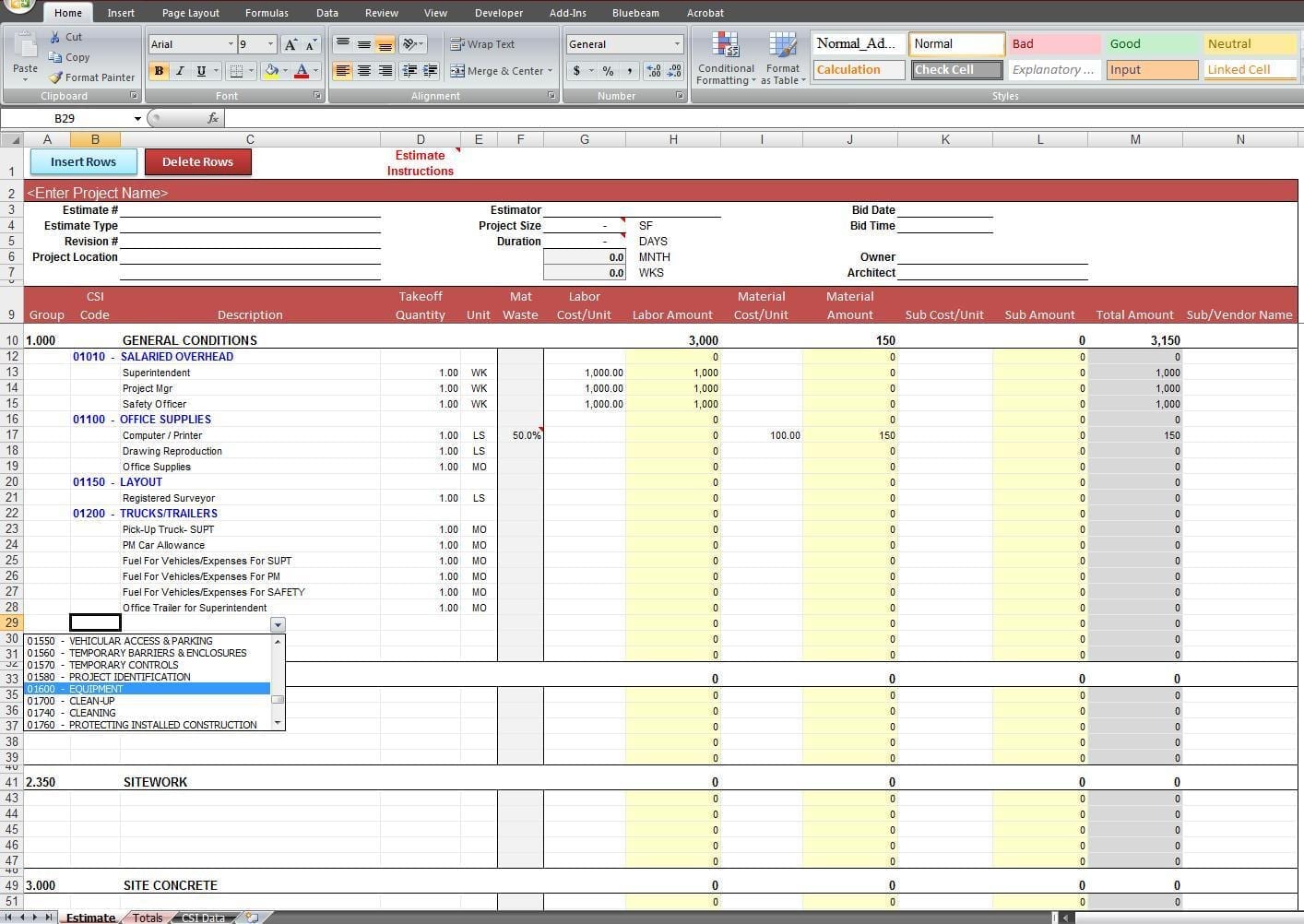

In the construction industry, for example, numerous workers and supplies are involved in each project, making detecting overspending challenging. Tracking construction expenses on a project basis allows managers to create more accurate forecasts and identify unexpected costs that could impact profits. Before we learn how to calculate job costing, let’s look at one of the tools that aid in job costing, called a costing sheet.

What Is Job Costing? When to Use a Costing Sheet (Example Included)

A job order costing system is already a complicated undertaking, and what you actually need is to reduce human participation and the likelihood of costly errors. Digitalization is the only option to manage the complete job cost sheet process. The only way to simplify this procedure is to centralize it on a strong field service management platform.

Project Budget Template

Understanding how to effectively use job cost sheets can lead to more informed decision-making and better resource allocation. Another difference is that costs can’t be transferred in job costing, but that can be across processes in process costing. Also, each job is different in job costing, but process costing is about projects produced in large volumes. Advantages include increasing the efficiency and profitability of your business, cost control, and improving your decision-making process in future endeavors.

Submit to get your retirement-readiness report.

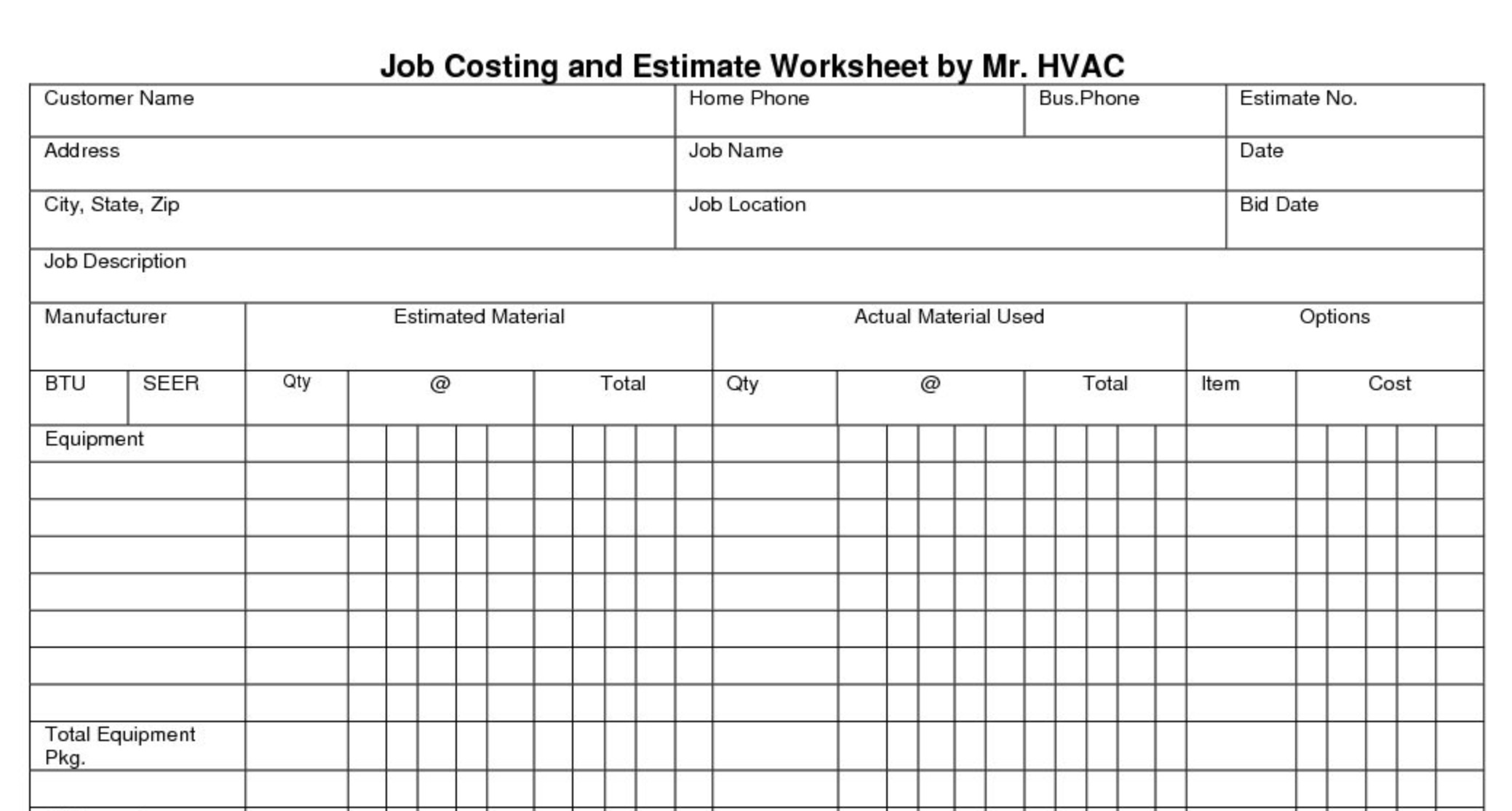

Payroll and accounting software can be used to generate labour costs and expenses for you, so you don’t have to spend time crunching the numbers. Job costing, also known as project-based accounting, is an accounting method used for tracking the cost and profitability of individual projects or “jobs” within a business. A job cost sheet is a document that lists the expenses incurred to execute a project. The accounting division frequently creates this report to check that spending stayed within predetermined limitations.

Streamline Project Costing with Smartsheet for Project Management

In addition to tracking direct costs, a costing sheet allows for the allocation of indirect costs to specific jobs. This is crucial for obtaining an accurate representation of the total cost of production. By apportioning indirect costs based on predetermined allocation bases such as labor hours or machine hours, project managers can gain insight into the complete cost picture of each job. One common method for allocating overhead is the use of predetermined overhead rates.

Use this simple construction project cost tracking spreadsheet to accurately estimate line-by-line and total construction project costs. Enter category and items, projected and actual costs, responsible parties, status, and percentage of each task complete. The template also doubles as a budgeting template by keeping tabs on amounts currently paid and due, so tax withholding you can see your projected and actual project total and track outstanding payments. Use this project cost tracking template to ensure that you accurately estimate the cost of your project, and that you capture all potential and actual costs. Designed for IT departments, this project costing template helps IT project managers accurately estimate project costs.

The most challenging aspect of cost allocation is handling overhead costs. Overhead costs are the general business expenses that are essential for running the construction company but are not directly attributable to any single project. This includes costs like office rent, insurance, executive salaries, and marketing expenses.

After that, the company will need to calculate its overhead rate and allocate the overhead. Job costing is a common process in construction accounting in which costs are assigned to individual construction projects, breaking down the expenses to understand where every dollar is spent. This systematic approach allows for early detection of any deviations from the budget, facilitating prompt corrective action to keep project costs within the established cost parameters. These costs encompass the wages paid to workers and staff involved in a specific project. To calculate this, you typically multiply the daily rate, the number of workers, and the estimated duration of the project.

A job cost sheet shows costs for specific jobs while a Standard Cost sheet outlines the detailed costs of producing a product. The two sheets may also use different time periods to record costs and activity figures. A job cost sheet is a document that shows the total cost of a job and its components. In addition to these costs, factory overheads incurred in November amounted to $44,000. The predetermined overhead rate can be applied to all other jobs and reconciled for actual costs at the end of the financial year. Material costs are all costs directly related to the material or service being sold.