The construction money will support the building of environmental shelters, a B-21 weapons generation facility and a B-21 squadron operations center. Wohlenberg Ritzman & Co., LLC offers a full complement of federal, state, and local tax services designed to proactively manage your tax responsibilities and minimize tax burden. Having worked in emergency management and ran several of his own businesses, Lee eats problems for breakfast. You can’t have someone more qualified to navigate the thousands of pieces that go into building a new home. The base’s commander told the Black Hills Forum and Press Club last year that the base’s population is set to grow by about 4,000 people, to nearly 12,000. That anticipated growth has sparked legislative discussions on ways the state might financially support entities like the Douglas School District, which serves Ellsworth.

IRS Representation

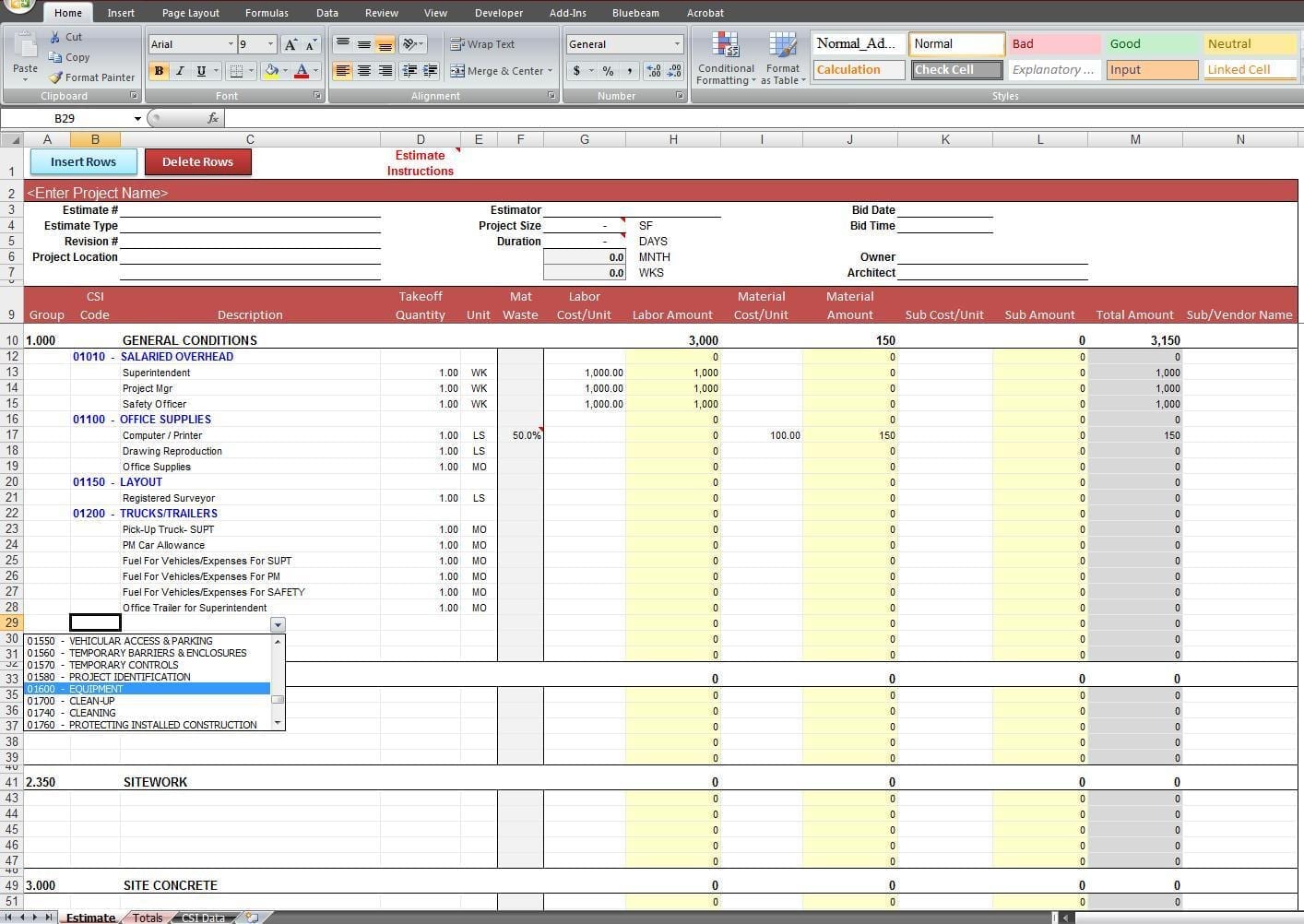

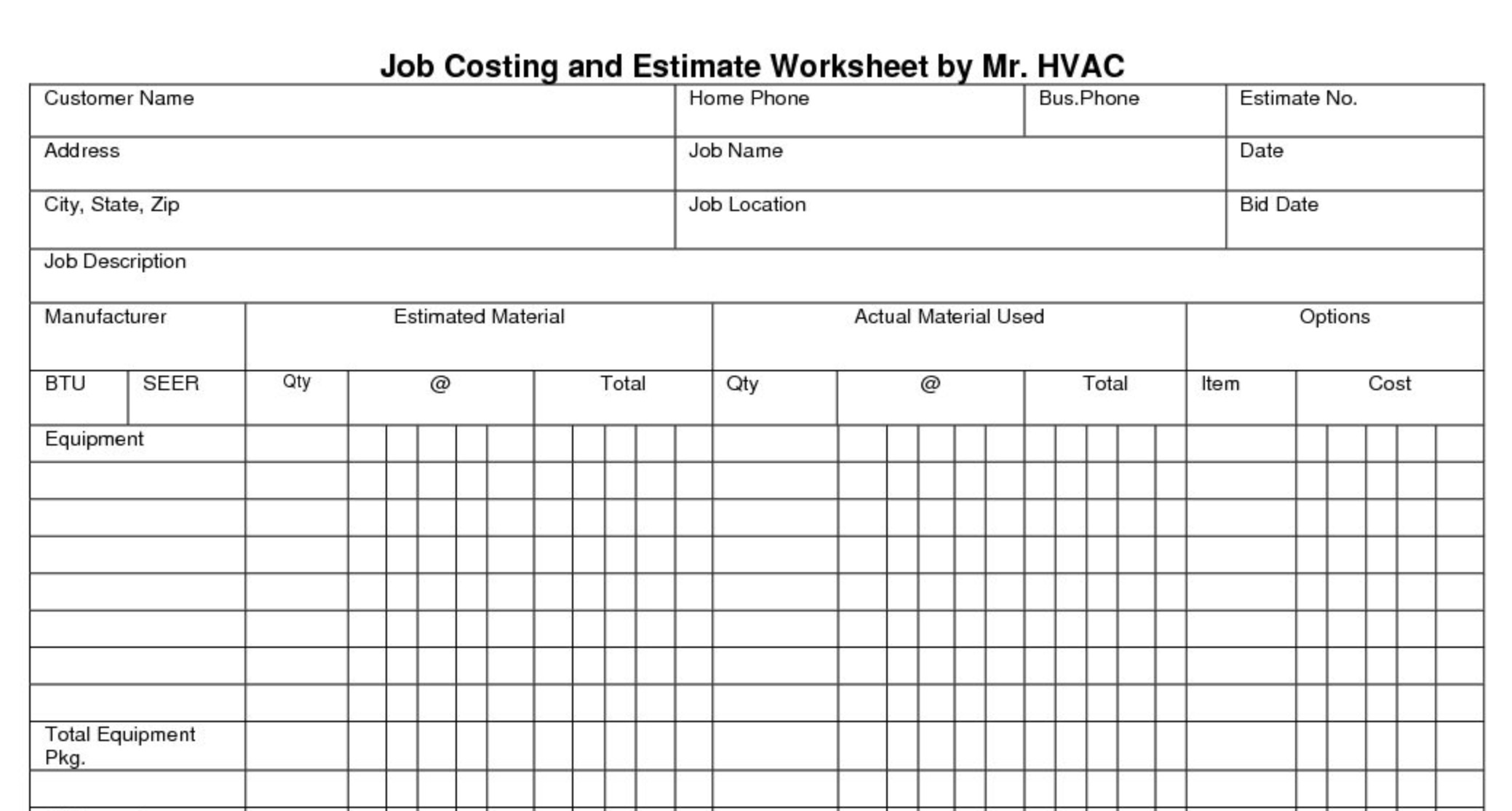

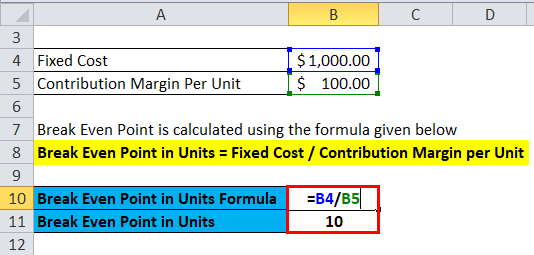

Managing finances effectively is crucial for general contractors to ensure business success and long-term stability. Construction accounting requires careful attention to detail, as the industry’s unique nature demands accurate tracking of expenses, cash flow, and taxes. By implementing strong construction bookkeeping services, contractors can gain clear insight into their financial position, make informed decisions, and avoid common pitfalls that may hinder business growth. By following these essential tips, general contractors can maintain organized and accurate financial records, allowing them to make informed business decisions. Whether it’s tracking expenses, setting aside money for taxes, or preparing for growth, keeping your finances in order is key to success in the construction industry. For those looking for expert assistance, Meru Accounting offers specialized construction bookkeeping services to help manage your finances, ensuring that your business stays on the right track.

The Clear Choice for Your Construction Accounting

Avoid payroll filing issues and day-to-day processing by handing complex payroll work over to us.

Payroll

Combining the 2 creates the perfect combo to help you design your perfect layout. This business has not enabled messaging on Yelp, but you can still contact other businesses like them. Explore tips on financial readiness, team resilience and festive https://azbigmedia.com/real-estate/commercial-real-estate/construction/how-to-leverage-construction-bookkeeping-to-streamline-financial-control/ traditions to close out the year.

Professional Service Providers

Financial statements also represent your business to lenders, partners, potential buyers and other interested parties. I will work closely with your key personnel to develop and finalize accurate and timely financial statements. Please avoid obscene, vulgar, lewd,racist or sexually-oriented language.PLEASE TURN OFF YOUR construction bookkeeping CAPS LOCK.Don’t Threaten.

Maximizing your charitable donations before year-end: A tax-savvy guide

We’ll construct a plan to help lead you toward financial success. Wisconsin Democratic Sen. Tammy Baldwin, the Senate’s first openly LGBTQ member, voted against the bill and accused Republicans of seeking “cheap political points” by barring gender-affirming care coverage. The National Defense Authorization Act passed Wednesday by the U.S. Senate includes $282 million for construction at Ellsworth Air Force Base near Rapid City. Maria Promes, who is the property manager for Gurney Flats, has already been showing apartments to prospective clients.

- If you’re looking for a firm that will focus on your individual needs, and always treat you like a client who matters, look no further.

- Whether you are developing a retirement plan for yourself or choosing a retirement plan to offer to your employees, I can help you evaluate the available options.

- We are committed to helping professional service providers build successful enterprises.

- The weather helped the construction move along this season, but the size of the project has posed a few difficulties.

- Rothschadl encouraged people to follow the construction speed limits and use extra caution when traveling through.

By combining our expertise, experience and the team mentality of our staff, we assure that every client receives the close analysis and attention they deserve. Our dedication to high standards, hiring of seasoned tax professionals, and work ethic is the reason our client base returns year after year. With DB&B, you have a trusted team of construction accounting professionals who have years of experience and a record of results. In a news release on the legislation, South Dakota Republican John Thune praised the vote as a win for the state.

- General contractors should not only focus on current projects but also plan for future growth.

- The business entity—LLP, LLC, sole proprietorship, partnership, corporation, etc.— that you select for your business has enormous financial and tax implications.

- Constantly changing federal, state and local laws and tax regulations make payroll management an ongoing challenge for business owners.

- Working in the wedding industry basically means she can balance ultimate dreams and crazy wishes.

- You can’t have someone more qualified to navigate the thousands of pieces that go into building a new home.

- Because of the general lack of inclement weather over the past 12 months, a mild winter last year and the beginning of one this year, the project is well ahead of schedule.

Plan for Growth and Expansion:

Construction cost accounting is a major factor for the success or failure of contractors and firms in the construction industry. We understand there’s a lot to consider, from overall project costs to budgeting for materials, tools, equipment, labor and everything in between. Whether you are developing a retirement plan for yourself or choosing a retirement plan to offer to your employees, I can help you evaluate the available options.

Construction bookkeeping services can help in setting up systems to track income and expenses efficiently, providing timely reports to help you stay on top of your finances. While our accounting firm is based in Syracuse NY, we have the capabilities, knowledge and experience to provide construction accounting to any organization regardless if you’re 5 miles away or 5,000 miles away. With construction accounting from DB&B, you get more insights with a faster turnaround than in-house accounting without the cost of an employee. Reconciling bank statements is an important task ensuring your records match your business account’s actual transactions.