When purchasing QuickBooks Desktop Pro, there are several additional fees to be aware of. Intuit isn’t always very forthcoming with these add-ons and fees, so we wanted to share them. In the next few sections, we’ll cover the pricing structures of QuickBooks Pro, Premier, and Enterprise in more detail. We’ll also discuss the features of each product and guide you on how to choose the right QuickBooks Desktop edition for your business. All QuickBooks Desktop Pro, Desktop Premiere, Mac, and Desktop Enhanced Payroll products, excluding QuickBooks Desktop Enterprise, will no longer be available to new users after September 30, 2024.

QuickBooks Enterprise Pricing

It has everything from the Plus plan but with more integrations and customizations. For example, you can set up automatic workflows and backups for better efficiency and productivity. So everyone on your team, online and offline, can use it to manage your store. On the other hand, the profitability tracking feature lets you view details such as labor costs, expenses, and income.

Tracking your inventory includes your what is a debit and credit bookkeeping basics explained products and the cost of goods. All your bills are displayed in one dashboard, so you can avoid missed or delayed payments. So you can see where the money is coming in and out of your business. You can even set tax categories to organize them and save time during tax season.

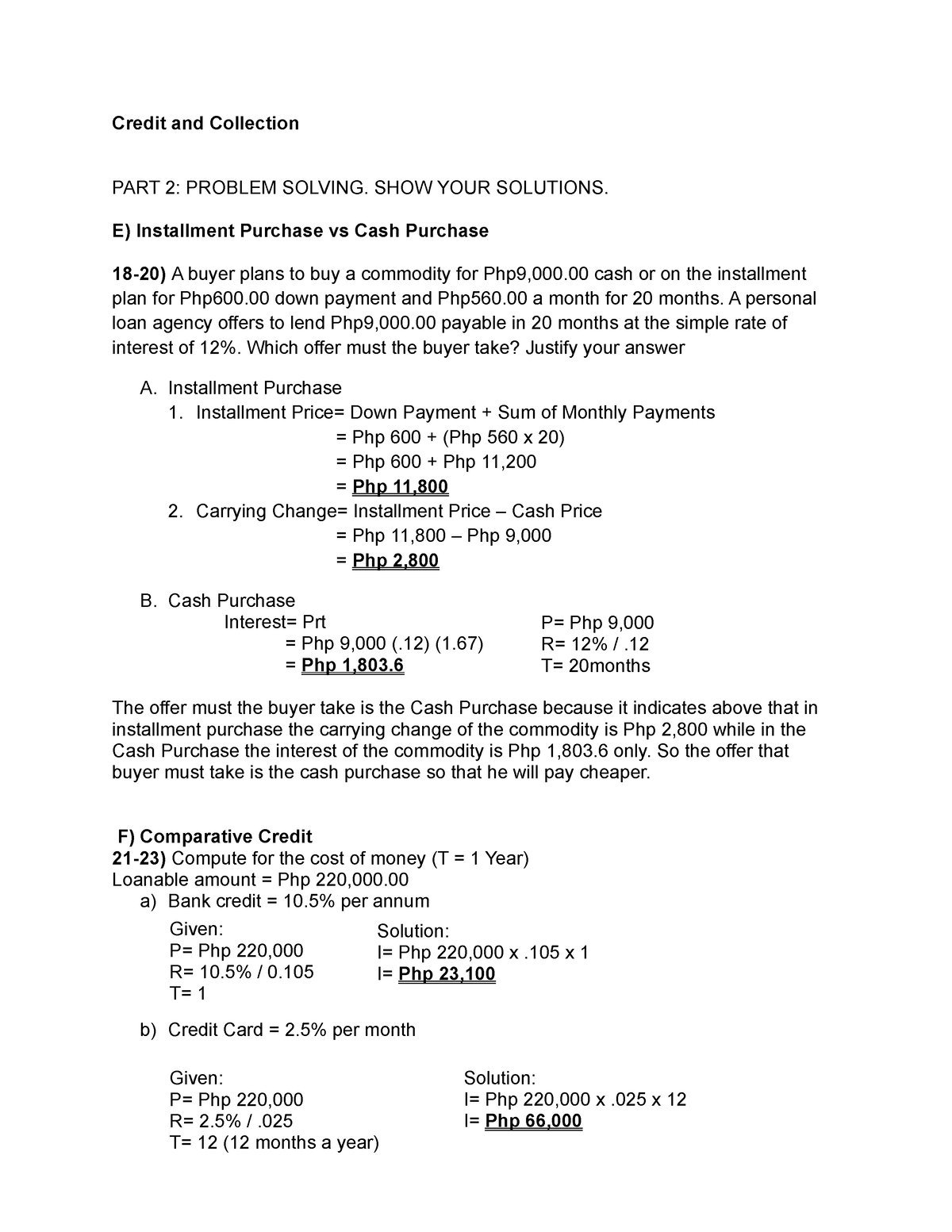

Although you can track expenses, QuickBooks Simple Start doesn’t enable users to pay bills. If you want the benefits of QuickBooks Premier Plus with QuickBooks Enhanced Payroll, sign up for the QuickBooks Premier Plus + Payroll plan. QuickBooks Premier Plus + Payroll costs $1,049.99/year, although Intuit frequently offers significant discounts on this product.

Quickbooks Online Pricing

- Today’s leading accounting platforms offer standard security features like data encryption, secure credential tokenization and more.

- Health benefits come from SimplyInsured and include medical, dental, and vision insurance packages.

- The available options range from basic voucher checks to secure premier voucher checks.

- QuickBooks Checking Account opening is subject to identity verification and approval by Green Dot Bank.

With QuickBooks Payments, you can accept credit and debit card payments, ACH transfers, and Apple Pay payments. This add-on lets you add a stella and dot stylist review «Pay Now» button to your invoices. This makes payments more convenient, which can lead to quicker payoffs. But you’ll still have to choose the specific packages for each one.

QuickBooks Pro Plus + Payroll

QuickBooks is the platform most used by professional accountants so if you plan to work with an accountant, they will likely be very familiar with the platform, its features and capabilities. Take time to evaluate the pricing tiers, add-on fees like payroll and apps, available discounts, and how costs compare to alternative platforms. This allows you to make the optimal QuickBooks Online buying decision for your financial situation, accounting needs, and stage of business growth.

If you previously purchased QuickBooks Desktop licensing, you can continue to use the software as long as you like. However, be aware that support for your product will end three years after its release. Unfortunately, QuickBooks is no longer forthcoming with the pricing of its QuickBooks Desktop products. Outside of QuickBooks Enterprise, pricing for QuickBooks Desktop products is not listed online. Qualified bookkeepers handle everything from data entry to reconciliations, accounts payable/receivable, financial report generation, and more.

All plans include

QuickBooks is an accounting software designed for a wide range of independent contractors and businesses. It offers both cloud-hosted and on-premise solutions, designed to help simplify taxes, payroll and deductions. QuickBooks automatically syncs with your bank and credit card accounts, sends and tracks invoices, runs reports and more. QuickBooks Desktop Pro Plus is ideal for small businesses that need robust, locally installed accounting software for up to three users.

You’ll also get free online training with this plan, which can benefit you and your employees. But it can also be costly if you don’t need all its features. For example, you might not need to track mileage or send estimates. If you have the QuickBooks Payments add-on, they can pay directly the 7 best expense tracking apps for smarter business travel through the invoice, making it convenient.